Do you think that in markets where the price can change in a split second, placing orders should be as simple as possible? In Metatrader, each time you want to open an order, you have to open a window where you enter the opening price, stop loss and take profit, as well as the trade size. In trading the financial markets, capital management is essential to maintain your initial deposit and multiply it. So, when you want to place an order, you probably wonder how big a trade you should open? What percentage of your deposit should you risk on this single trade? How much can you profit from this trade and what is the profit to risk ratio? Before you set the trade size, you do the necessary calculations to get an answer to the question of what the trade size should be.

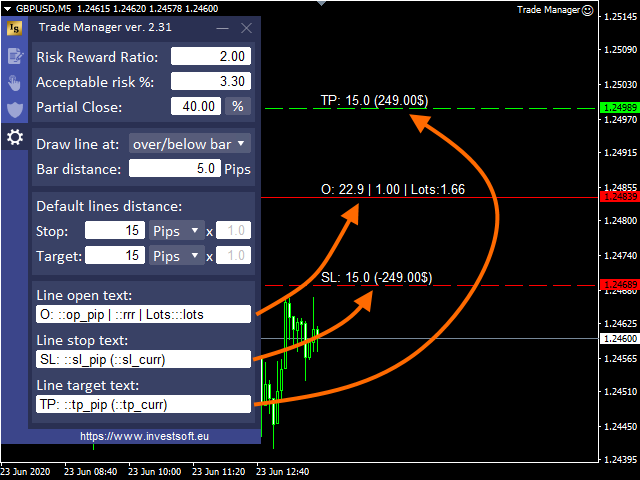

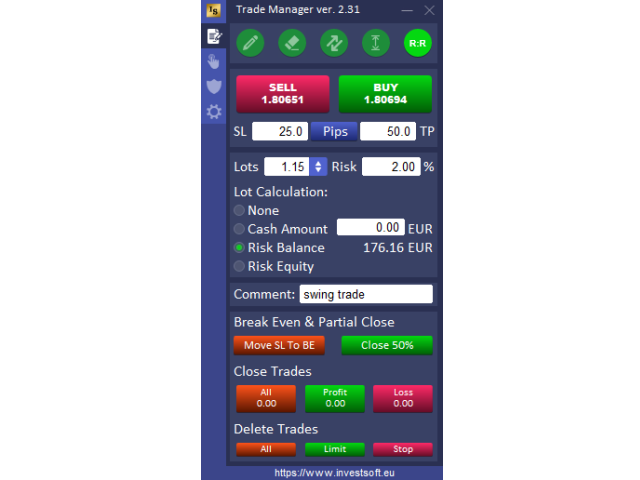

Imagine that you have a tool that does all this automatically. You open a chart, make a market analysis and mark with horizontal lines the entry point, defence point (stop loss) and target (take profit), and at the end you define the level of risk, e.g. as a % of available capital, that you are able to bear in this transaction, and the program at this point provides:

- the acceptable transaction size for the defined risk and stop loss size

- Stop Loss and Take Profit values in pips, points and account currency

- risk to reward ratio

Now all that remains is to click the appropriate button on the panel to open the trade

If you are a scalper and need to quickly open and close trades without setting defenses or targets, then you have everything at your fingertips in the Trade Manager panel, where you can define fixed order parameters and quickly open them by clicking the ‘Buy’ or ‘Sell’ button.

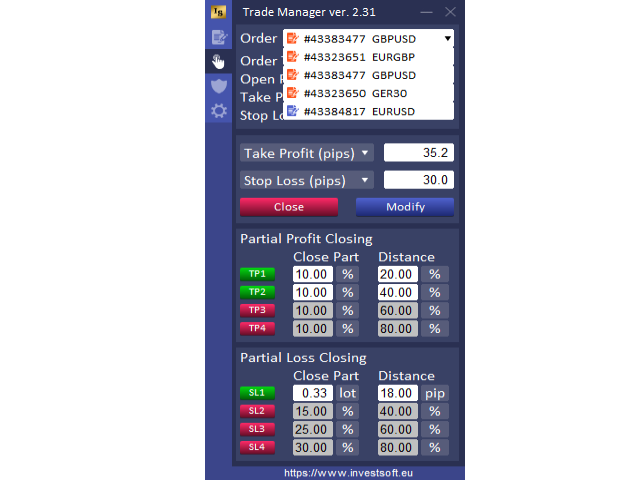

Closing or deleting orders is also done directly from the Trade Manager panel, where you can close everything with one button, or select a specific type of pending order, or close only profitable or loss-making trades.

Another problem with forex trading is trade management. You have probably encountered a situation where you stepped away from the screen for a moment and the market made a sudden move. If you had been at your computer at the time, you would have been able to gain a lot more by reacting quickly enough.

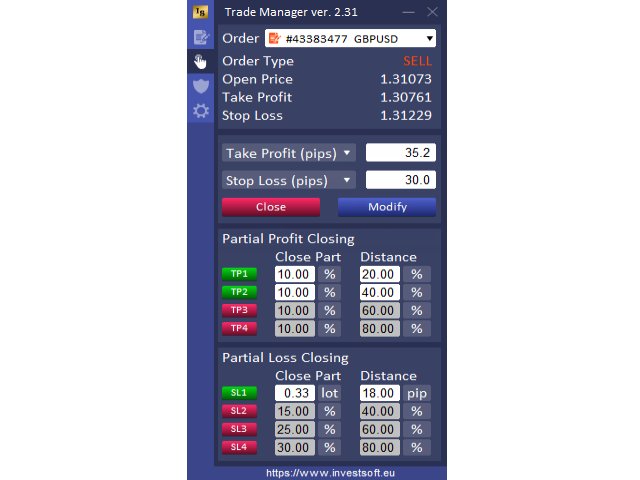

In this situation, the best solution is to set up a robot to control your trades 24 hours a day. In Trade Manager you have the following functions for managing your positions:

- automatic break even – the program will protect your trade from loss when it reaches minimum profit

- trailing stop – as your trade gains, the program secures another portion of the profits

- partial closes – as the price moves in the right direction and your trade reaches further intermediate targets, the program will start to realise profits by closing further parts of the trade

- one-cancels-the-other order (OCO) – you can set up opposite pending trades, e.g. expecting the price to break out of a consolidation. If one of these is activated, the program will automatically cancel the other trade.

By using the Trade Manager in your day-to-day trading you are always aware of the risks you are taking, and you keep your trades and your account under control at all times.

The Trade Manager’s intuitive and straightforward interface means that it will only take a moment to get to grips with the program, and our technical support is available whenever questions arise. If you want to have an edge in the market, you need to be “armed” with good tools.

Reviews

There are no reviews yet.